Unlock the Secret to Homeownership: The Ultimate Guide to Buying an Apartment

Introduction:

Embarking on the journey of buying an apartment is a significant milestone in life. Whether you’re a first-time homebuyer or an experienced investor, navigating the complex real estate market can be daunting. This comprehensive guide will empower you with the knowledge and strategies you need to make an informed decision and secure your dream home.

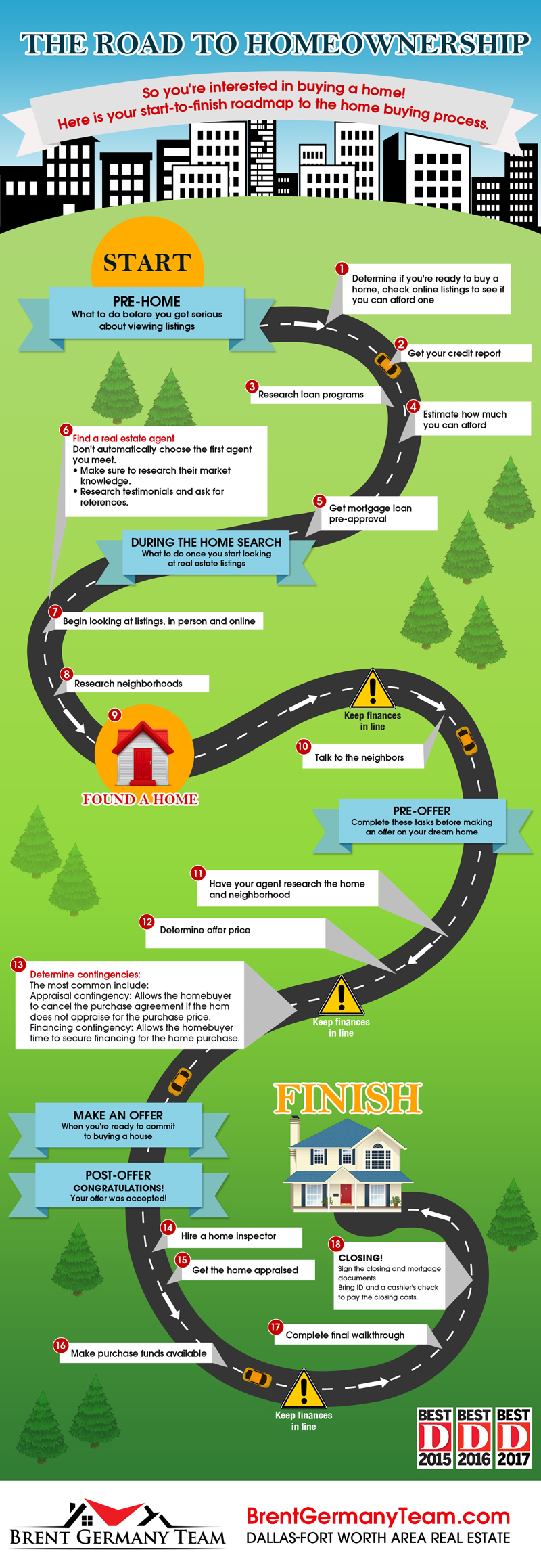

Step 1: Determine Your Needs and Budget

- Assess your lifestyle: Consider your current and future living requirements. Do you prefer a spacious layout or a cozy studio? How many bedrooms and bathrooms do you need?

- Set a realistic budget: Determine your financial capacity by calculating your income, expenses, and savings. Consider not only the purchase price but also closing costs, property taxes, and maintenance expenses.

Step 2: Research the Market

- Explore neighborhoods: Research different neighborhoods to find one that aligns with your lifestyle, commute, and amenities. Consider factors such as safety, schools, and community atmosphere.

- Compare properties: Use online real estate platforms and consult with a real estate agent to compare available properties. Pay attention to square footage, floor plans, and building amenities.

Step 3: Get Pre-Approved for a Mortgage

- Obtain a pre-approval letter: This will demonstrate to sellers that you’re a serious buyer and provide you with a clear understanding of your borrowing capacity.

- Shop for mortgage rates: Compare interest rates and loan terms from multiple lenders to secure the best deal.

Step 4: Find a Real Estate Agent

- Interview potential agents: Look for an experienced and reputable agent who understands your needs and the local market.

- Sign an agency agreement: This will outline the agent’s responsibilities, commission, and the terms of your representation.

Step 5: View Properties and Make an Offer

- Schedule viewings: Visit potential apartments with your agent and carefully inspect the property, paying attention to condition, layout, and amenities.

- Negotiate and make an offer: When you find a suitable property, work with your agent to negotiate the purchase price and other terms.

Step 6: Conduct Due Diligence

- Order a home inspection: Hire a licensed home inspector to thoroughly examine the property and identify any potential issues.

- Review the HOA documents: If the property is part of a homeowners association (HOA), carefully review the governing documents to understand the rules and regulations.

Step 7: Close on the Property

- Attend the closing: This is where you will sign the final loan documents and transfer ownership of the property.

- Pay closing costs: These typically include loan origination fees, title insurance, and property taxes.

Tips for First-Time Homebuyers:

- Take advantage of down payment assistance programs: Explore government-backed programs that can help you reduce your down payment.

- Consider a starter home: Start with a smaller or more affordable property to build equity and gain experience.

- Don’t be afraid to ask for help: Consult with a real estate agent, mortgage lender, or financial advisor for guidance throughout the process.

Conclusion:

Buying an apartment is a major investment that requires careful planning and preparation. By following the steps outlined in this guide, you can navigate the real estate market with confidence and secure a home that meets your needs and aspirations. Remember to consult with professionals, research the market thoroughly, and make informed decisions to ensure a successful homeownership journey.